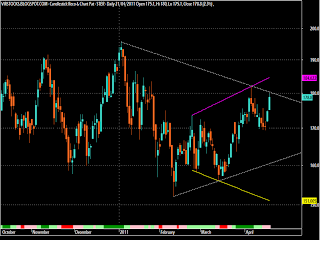

NIFTY VIEW:- SINCE 21-04-2-11 WE ARE SAYING THAT IF NIFTY CANNOT CROSS THE UPPER RESISTANCE CHANNEL , THE MKT. IS IN SHORT TERM CORRECTION MODE.. NOW TODAY WE SEE AS PER SHORT TERM TREND IS IN UP CHANNEL IS TERMINATED.. NIFTY HAS BROKEN IMPORTANT SUPPORTS.IF TODAY MARKET NOT SUSTAIN ABOVE 5830 (NIFTY CASH) LEVEL ON UP SIDE THEN WE SEE SOME CORRECTION IN MARKET.

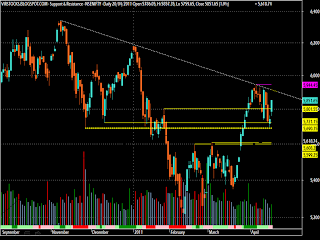

TCS : - THE BIG IT STOCK BREAKS IMP THE SUPPORT..1165.AS PER CHART OF TCS WE SEE IS IN UP CHANNEL BUT TODAY ITS BREAK CHANNEL ON DOWN SIDE AND GIVE A CLOSE (1160), ONE CAN GO SHORT NEAR 1165 FOR TARGATING 1140,1100,1088 WITH STRICT SL OF 1176.

OUR CALL GIVEN OF LUPIN ABOVE 420 :: LAST DAY IT WAS AT 435-438...1ST TGT ACHIEVED BOOK FULL PROFIT..

TCS : - THE BIG IT STOCK BREAKS IMP THE SUPPORT..1165.AS PER CHART OF TCS WE SEE IS IN UP CHANNEL BUT TODAY ITS BREAK CHANNEL ON DOWN SIDE AND GIVE A CLOSE (1160), ONE CAN GO SHORT NEAR 1165 FOR TARGATING 1140,1100,1088 WITH STRICT SL OF 1176.

OUR CALL GIVEN OF LUPIN ABOVE 420 :: LAST DAY IT WAS AT 435-438...1ST TGT ACHIEVED BOOK FULL PROFIT..