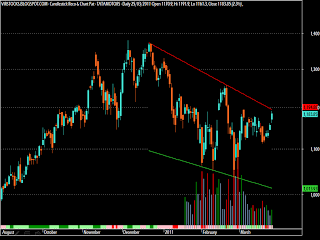

ACCORDING TO PAKS TEAM ...LAST 5 CONTINUOUS VICTORY TAKE THEM INTO OVERBOUGHT ZONE... ALSO 5 DAY WIN AVG..FAR..SO IND WILL BREAK THE TREND AND INDIA WILL WIN THE MATCH WITH FEW MARGINS...

TO,

MR..DHONI FINAL ME HAREGA TO CHALEGA LEKIN PAKISTAN KE SAMNE JITNA HI PADEGA... BEAT THEM...TECHNICAL VIEW IS IN UR FEVER....

TO,

MR..DHONI FINAL ME HAREGA TO CHALEGA LEKIN PAKISTAN KE SAMNE JITNA HI PADEGA... BEAT THEM...TECHNICAL VIEW IS IN UR FEVER....