Monday, February 28, 2011

FEW STOCKS NEAR SUPPORT ZONE ON WEEKLY BASE::

1.) BHEL:: WITH STRONG SUPPORT NEAR 1952-50 ONE CAN FROM HERE IN THIS STOCK... AND ALSO NEAR EXPANDING TRADE LINE SUPPORT..

FOR TGT :: 2100, 2230 WITH STRICT SL OF 1950...BELOW THAT ...???

2) INFOSYS TECH:: HEAVY IT STOCK NEAR END TO BULL RUN..BELOW 2980-2970 STOCK WILL GO INTO BEARISH MODE... ITS NEAR LAST SUPPORT ZONE...ONE CAN GO FOR SHORT NEAR 3040-3045 WITH STRICT SL OF 3080...

FOR TGT :: 2100, 2230 WITH STRICT SL OF 1950...BELOW THAT ...???

Saturday, February 26, 2011

Friday, February 25, 2011

Tuesday, February 22, 2011

NIFTY IS IN RANG BOUND CONDITIONS::STAY OUT THE MKT..

INDIAN MKTS. NEAR TO MONTH END EXPIRY AND BUDGET SCENARIO PLEASE STAY OUT OF THE MKTS. NIFTY RANGE SEEN NEAR TERM 5400-5600.. EITHER SIDE CLOSE WOULD DECIDE THE MKT. VIEW.. BEARISH OR BULLISH...

Sunday, February 20, 2011

Friday, February 18, 2011

Wednesday, February 16, 2011

OUR NIFTY VIEW FOR 17-02-11

NIFTY VIEW

TODAY NIFTY OPEN FLAT AND HOLD DAY IT WAS TRADE IN NERROW RANGE (5460-5504), SO TOMORROW MARKET BREAK EITHER SIDE WE SEE SOME MOVEMENT, DOWN SIDE 5410 AND UP SIDE 5556. TODAY OVERALL VOLUME IS ALSO COMPARE TO LAST SOME DAYS IS LOWER. SO WE NOT CLEAR ABOVE MARKET DIREACTION. BRODE RANGE IS 5400-5550.EITHER SIDE BREAK OUT OF THIS RANGE WE SEE SOME MOVEMENT IN MARKET.

HAVE A HAPPY TREADING DAY.

Tuesday, February 15, 2011

OUR NIFTY VIEW FOR 16-02-11

• TODAY NIFTY OPEN POSITIVE AND MADE NEW HIGH OF 5476 AND THEN AFTER WE SEE SOME SELLING PRESURE AND NIFTY COME DOWN AND MADE A LOW OF 5408.35, BUT THEN IT WAS START UPMOVE AND IN LAST HOUR IT WAS MADE NEW HIGH OF 5506.50 AND THEN WE SEE SOME SELLING AGAIN AND AT LAST NIFTY GIVE A CLOSE 5481. AS PAR CANDLESTICK PATTERN NIFTY MADE “BEARISH SPINNING TOP”ON DAILY CAHRT.SO IF NIFTY CROSS TOMORROW 5510 LEVEL WITH GOOD VOLUME THEN WE SEE IT WILL TOUCH 5556 LEVEL.

• HAVE A HAPPY TRADING DAY

ENJOY BOOK PROFIT

AS PAR OUR CALL ON YESBANK 1 ST TARGET ACHIVED 278 (HIGH277.4).

SO ENJOY THE POSITION AND BOOK PROFIT

SO ENJOY THE POSITION AND BOOK PROFIT

Monday, February 14, 2011

OUR NIFTY VIEW

NIFTY VIEW

TODAY NIFTY OPEN ALMOST FLAT AND THEN AFTER IT’S MADE HIGHER TOP HIGHER BOTTAM FORMATION HOLE DAY.AND AT LAST IT’S MADE HIGH OF 5467. IF TOMORROW NIFTY NOT BREAK 5410 LEVEL THEN WE SEE IT’S TOUCH 5556 LEVEL IN COMING DAYS.

HAVE A HAPPY TRADING DAY

BOOK PROFIT

AS PAR GIVAN CALL OF AXISBANK OUR 2 TARGET ACHIVED 1229-1260 .

PLEASE BOOK PORFIT IN AXISBANK OR IF SOME ONE WANT TO HOLD IT WITH TRAILING STOPLOSS OF 1229.ENJOY>>>>

PLEASE BOOK PORFIT IN AXISBANK OR IF SOME ONE WANT TO HOLD IT WITH TRAILING STOPLOSS OF 1229.ENJOY>>>>

Sunday, February 13, 2011

OUR NIFTY VIEW

AS PAR FRIDAY MARKET MOVEMENT WE SEE IN SECOUND HALF OF MARKET WE SEE IS GIVE A SMART UPMOVE AND BREAK THURSDAY HIGH OF 5272 WITH VOLUME,AND MADE NEW HIGH OF 5319.45. SO WE EXPECT MARKET GIVE UPMOVE ON MONDAY CONTINUE, AND NIFTY MAY TOUCH 5404,5450 LEVEL IN COMING DAYS.

Friday, February 11, 2011

NEW STOCK FOR BEARISH ::HINDALCO ::

SELL HINDALCO AS THE STOCK IS ENTERING IN NEGATIVE MACD AND ADX ALSO IN SELL REGION..DONT AVOID .. SELL AROUND 216-217 WITH TGT OF 210, 210.. WIHT STRICT SL OF 222.. ONE CAN BUY PUT OF STRIKE PRICE 220 ,210 ...ITS PURE RISK OF YOURS PROFIT WILL ALSO YOURS..

BOOK PROFIT IN TCS :: IN FNO:

SELL CALL GIVEN ON 8TH FEB..AT 1130 WITH TGT OF 1116 AND 1090...LAST DAY LOW WAS 1072 IN CASH.. STEEL STOCK IS IN BEARISH MODE..

Thursday, February 10, 2011

BUY BEML : HIGHLY OVERSOLD STOCK .. WITH LOW RISK..

AS PAR 1ST CHART (WEEKLY) OF BEML WE SEE IS BREAK ALL SUPPORT,

AS PAR 2ND CHART WE SEE IS IN HIGH OVERSOLD ZONE, SO WE TRY TO GO LONG IN THIS STOCK NEAR 848(GAPE FILL UP) FOR DELIVARY WITH STOPLOSS OF 527 FOR TARGET 650-670-765.

INDIAN MARKETS ARE STILL IN BEARISH MODE: IN OUR RECOMMENDS ABAN STOPLOSS GIVEN AT 640... THEN THINK OF THE STOCK...SO STRICTLY FOLLOW THE STOPLOSS..PLEASE..

AS PAR 2ND CHART WE SEE IS IN HIGH OVERSOLD ZONE, SO WE TRY TO GO LONG IN THIS STOCK NEAR 848(GAPE FILL UP) FOR DELIVARY WITH STOPLOSS OF 527 FOR TARGET 650-670-765.

INDIAN MARKETS ARE STILL IN BEARISH MODE: IN OUR RECOMMENDS ABAN STOPLOSS GIVEN AT 640... THEN THINK OF THE STOCK...SO STRICTLY FOLLOW THE STOPLOSS..PLEASE..

Tuesday, February 8, 2011

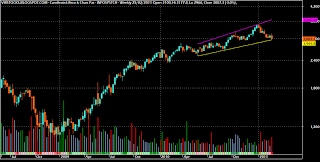

TCS LTD..:: VIRGIN STOCK FOR BEARS;;

AS PAR 1ST CHART OF TCS WE SEE TODAY IS BREAK UPWARD SUPPORT LINE (1140),

AS PAR 2ND CHART WE SEE SOME IMPORTANT LEVELS, SO WE GO SHORT WITH STOPLOSS OF 1140 FOR TARGET 1116,1112,1090.

ANOTHER VIEW WITH LONG TERM BULL RUN ENDS..IN THIS STOCKS ALL THE TECHNICAL PARAMETERS ARE NEGATIVE AND THE STOCK IS STILL IN HIGHER RANG..

AS PAR 2ND CHART WE SEE SOME IMPORTANT LEVELS, SO WE GO SHORT WITH STOPLOSS OF 1140 FOR TARGET 1116,1112,1090.

ANOTHER VIEW WITH LONG TERM BULL RUN ENDS..IN THIS STOCKS ALL THE TECHNICAL PARAMETERS ARE NEGATIVE AND THE STOCK IS STILL IN HIGHER RANG..

Monday, February 7, 2011

SELL SELL ONLY SELL IN MKT. NOW STATE BANK OF INDIA :: INTRADAY SELL AND F&O SELL ...BANKING STOCK

AS PAR 1ST CHART OF SBIN WE SEE IS IN DOWN CHANNEL AND TODAY IS TOUCH UPPER LINE OF DOWN CHANNEL AND COME DOWN,

AS PAR 2ND CHART WE SEE SOME LEVELS. SO WE GO SHORT IN THIS STOCK WITH STOPLOSS OF 2688 FOR TARGET 2560,2535...2487 AND 2463...

AS PAR 2ND CHART WE SEE SOME LEVELS. SO WE GO SHORT IN THIS STOCK WITH STOPLOSS OF 2688 FOR TARGET 2560,2535...2487 AND 2463...

SELL SELL ORCHID CHEM :: INTRADAY AND F&O CALL ...

DAILY CHART OF ORCHID CHEM SHOWS US ITS IN TRIANGLE PATTERN AND TODAY IS CLOSE 289 NEAR SUPPORT LINE(285) SHOW SELL BELOW THIS LEVELS.. WITH TGT OF 277..265..259 AND WITH STRICT SL OF 290..

Friday, February 4, 2011

BULLS CONTINUE IN HUL ... AND NIFTY IN 5550-5400 RANGE

THOUGH WE HAVE STOPLOSS IN NIFTY, CALL GIVEN ON MONDAY BUY NIFTY AT 5450 WITH TGT OF 5570,5620...LETS WATCH IF NIFTY IS GOING TO ACHIEVE OR NOT.. ONCE AGAIN THE RANGE OF NIFTY 5550-5400 IS VERY CRUCIAL.. ONE CAN STAY OUT OF THE MKT..TILL TRENDS CLEAR..

CONTINUE WITH HIND.UNILEVER BUY GIVEN AT 275 WITH TGT OF 282 (ACHIVED)..290 AND 304.. MODIFTY SL WITH 272..

CONTINUE WITH HIND.UNILEVER BUY GIVEN AT 275 WITH TGT OF 282 (ACHIVED)..290 AND 304.. MODIFTY SL WITH 272..

Wednesday, February 2, 2011

NIFTY FROM 5539 TO 5402:: ITS HUGE..SET BACK FOR BULLS..

ON MONDAY WE GIVEN CALL OF BUY NIFTY AT 5450-55...IT HAS GONE UP THENAFTER BUT COULD NOT COULD NOT SUSTAINED ON HIGH.. THANKING THAT ALL OF U HAVE MADE STOPLOSS AROUND 5440...SORRYYY.....

ABAN ALSO GONE UP THEN AFTER ALSO CRACKED DOWN...EXIT FOR TRADER AND WAIT FOR INVESTOR IN THIS STOCK...

ABAN ALSO GONE UP THEN AFTER ALSO CRACKED DOWN...EXIT FOR TRADER AND WAIT FOR INVESTOR IN THIS STOCK...

Tuesday, February 1, 2011

BUY TITAN IND.:: POSITIONAL BUY::

CHART OF TITAN SHOWS US THE STOCK IS IN TRIANGLE PATTERN AND TODAY IS CLOSE NEAR UPPER LINE OF PATTERN AND TODAY IS MADE “BULLISH ENGULFING CANDLE STICK PATTERN”.FOR RISKY TRADER GO LONG ABOVE 3633 ONLY WITH SOME SL.(MAY BE 1-2 %) FOR TARGET 3736,3830

AS PAR 2ND CHART WE SEE SOME IMPORTANT LEVELS.

AS PAR 2ND CHART WE SEE SOME IMPORTANT LEVELS.

WE WILL CONTINUE TODAY WITH OUR YESTERDAY CALL:

LAST DAY WE HAVE RECOMMENDED...BUY NIFTY AROUND(CASH LVL) 5450-5455.. CLOSE WAS 5505.. STILL THE TGT ARE: 5570, 5620.. MODIFY OUR SL TO 5440...

BUY ABAN:: FOR 2-3 DAYS...

CHART OF ABAN OFFSHORE SHOWS US ITS FAR AWAY FROM 5-DAY EMA..AND POSITIVE HAMMER IN DAILY..SO BUY IN SMALL QUANTITY ABOVE 675 WITH TGT OF 692..708..WITH STRICT SL OF 666..

FOR MID - LONG TERM INVESTMENT, ITS A GOOD OPPORTUNITY AROUND THIS LEVEL BUT KEEP THE STRICT SL OF 640 ON CLOSING BASE...

FOR MID - LONG TERM INVESTMENT, ITS A GOOD OPPORTUNITY AROUND THIS LEVEL BUT KEEP THE STRICT SL OF 640 ON CLOSING BASE...

Subscribe to:

Posts (Atom)